|

QUESTION

* To ask the Minister for Housing; Planning and Local Government the estimated first and full year cost of recommencing the 1999 affordable purchase scheme stood down in 2011. * To ask the Minister for Housing; Planning and Local Government the amount spent on the affordable housing initiative through site grants and other departmental funding per annum since its inception from 1999 until its disestablishment; the number of units provided per annum through that period in tabular form; and if he will make a statement on the matter. * To ask the Minister for Housing; Planning and Local Government the amount spent on the low cost housing sites initiative through site grants per annum since its inception from 1999 until its disestablishment; the number of sites provided per annum through that period in tabular form; and if he will make a statement on the matter. REPLY Data relating to activity under the Sale of Sites Scheme are available on my Department's website at the following web-link: http://www.housing.gov.ie/housing/statistics/affordable-housing/affordable-housing-and-part-v-statistics. Data concerning activity under the Part V Scheme, the Shared Ownership Scheme, the 1999 Affordable Housing Scheme and the Mortgage Allowance Scheme are also available on my Department's website and can be accessed at the following web-link: http://www.housing.gov.ie/housing/statistics/affordable-housing/affordable-housing-and-part-v-statistics. Information regarding Exchequer funding for affordable housing is currently being collated and will be forwarded to the Deputy in accordance with Standing Orders. I have commenced the relevant provisions of the Housing (Miscellaneous Provisions) Act 2009, the effect of which is to place a new scheme for affordable purchase on a statutory footing. It is intended that the income thresholds will be the same as for the Rebuilding Ireland Home Loan, and other criteria will be set out in regulations. The elected members of each local authority will be responsible for determining the order of priority to be accorded to eligible households, in line with the framework of the national scheme. To support the main local authorities concerned in getting their sites ready for affordable housing, I am redirecting the €50 million funding for phase 2 of the Local Infrastructure Housing Activation Fund to the Serviced Sites Fund, increasing the scale of the fund from the previously announced €25 million to €75 million, to cover the period to 2021. To drive activity, I will be inviting applications for funding under the Serviced Sites Fund later this week.

0 Comments

QUESTION

To ask the Minister for Health the number of persons waiting for home care packages in the north County Dublin LHO area. REPLY As this is a service matter I have asked the Health Service Executive to respond directly to the Deputy as soon as possible. QUESTION

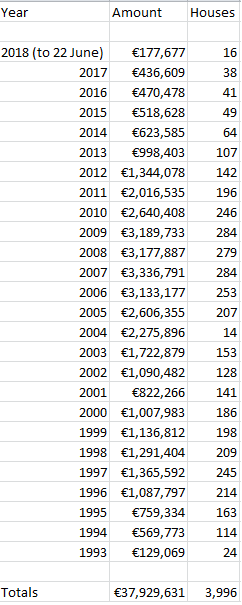

To ask the Minister for Housing; Planning and Local Government the amount spent on the mortgage allowance per annum since its inception until its disestablishment; the number of units provided per annum through that period in tabular form; and if he will make a statement on the matter. REPLY The Mortgage Allowance scheme provides for an allowance of up to €11,450 payable over a 5 year period, to tenants or tenant purchasers of local authority housing, to assist them to purchase or have a private house built with a mortgage. New applications are still being accepted by local authorities under the scheme. The amount spent on the scheme, and the number of housing units supported, are as follows: QUESTION

* To ask the Minister for Housing; Planning and Local Government the estimated first and full year cost of recommencing the shared ownership scheme stood down in 2011. * To ask the Minister for Housing; Planning and Local Government the amount spent on the shared ownership scheme per annum since its inception from 1991 until its disestablishment; the number of units provided per annum through that period in tabular form; and if he will make a statement on the matter. REPLY In 2011, the Government announced the standing down of all affordable housing schemes, including the Shared Ownership (SO) scheme, given the changes in the property and lending markets. From 1991 to 2010, a total of 16,492 loans were issued under the scheme, of which 3,323 remained at the end of Q4 2017. Data in relation to activity under the Shared Ownership Scheme (and other affordable housing schemes) is available on my Department's website at the following link: http://www.housing.gov.ie/housing/statistics/affordable-housing/affordable-housing-and-part-v-statistics. Information is readily available on the costs of the SO scheme per annum from its inception until its discontinuance. There are no plans at this time to develop a new Shared Ownership (SO) scheme. If such a scheme was to be introduced, any costs arising would be determined by the terms of the scheme and the number of eligible applications received. QUESTION

To ask the Minister for Housing; Planning and Local Government the budget for the Residential Tenancies Board in each of the years 2011 to 2017 and to date in 2018. REPLY The Residential Tenancies Board’s (RTB) funding is derived primarily from a proportion of the fee income accruing from tenancy registrations, as set down by Ministerial Order. This income was intended to enable the RTB to move to an entirely self-financing position in 2010. However, due to a deterioration in the RTB’s finances as a result of reduced registrations, a growing demand for RTB services and new functions under amendments made to the Residential Tenancies Act 2004, it has become necessary to provide direct Exchequer funding to supplement fee income. Section 176 of the Residential Tenancies Act provides that the fees received by the Residential Tenancies Board under the Act shall be paid into, or disposed of for the benefit of, the Exchequer in such manner as I, as Minister, may direct. By various Ministerial Directions since 2005, a percentage of fees received by the RTB under the Act has been allocated for transfer to local authorities for the purpose of the performance of their functions under the Housing Acts in relation to private rental standards inspections. Since 1 July 2016, the RTB retains the entirety of the fees received under the Act to defray its costs. Demand for the RTB’s services has increased significantly, due to the increasing size of the rental sector and also because of the changing regulatory structure. Furthermore, a number of additional functions have been added to the remit of the RTB since 2016, including: - implementation of new Rent Predictability Measures, such as the introduction of Rent Pressure Zones and associated on-going analysis, - increased engagement with the Approved Housing Body (AHB) Sector, - integration of Rent Tribunal functions into the RTB, - introduction of Free Mediation Services, - development of a voluntary Landlord Accreditation Scheme, - establishment of a one-stop shop, - establishment of one-person Tribunals, - increased Education/Awareness and research role, and - consideration and analysis in respect of a Deposit Protection Scheme. In 2016, my Department provided some €668,000 in Exchequer funding to the RTB. €170,000 of this amount was a requirement that arose outside of the 2016 Estimates process during the year, for an advertising campaign carried out by the RTB in quarter 1 2016, highlighting changes on foot of the Residential Tenancies (Amendment) Act 2015. In 2017, Exchequer funding of €2,329,000 was paid by my Department to the RTB. Included in this amount was €265,000 additional funding outside of the Estimates process in 2017, that arose during the year in respect of : 1. the provision of Fire Safety leaflets to all landlords to ensure they are aware of their responsibilities and obligations in respect of fire safety requirements - €107,200; 2. €112,000 in respect of an Auto-address Eircoding project which was required to support the roll-out of the Rent Pressure Zone measure; and 3. Legal costs - €46,000. RTB drawdown of Exchequer funding to date in 2018 amounts to €2.355m (from the overall allocation of €5.341m for 2018), primarily to support the operational costs of the RTB’s core functions and the additional powers and functions to be rolled out to the RTB over a multi-annual change period which will empower the RTB by giving it the necessary powers and resources to protect tenants and landlords in the residential rental sector. Details of the RTB’s own self-financing income and expenditure can be found in the RTB Annual Report and Financial Statements at the following link: https://onestopshop.rtb.ie/rtb-publications/. QUESTION

To ask the Minister for Housing; Planning and Local Government the estimated cost of establishing a national deposit scheme; and if he will make a statement on the matter. REPLY The Residential Tenancies (Amendment) Act 2015 provides for, among other things, the establishment of a tenancy deposit protection scheme to be operated by the Residential Tenancies Board (RTB). There have been significant changes in the rental market since the 2015 scheme was first envisaged and designed. For example, the draft scheme was originally intended to be financed by the interest payable on deposits lodged; this is no longer viable, given current financial market conditions. Furthermore, it is noteworthy that disputes relating to deposits are no longer the most common dispute type referred to the RTB. Financing the operation of the scheme is an important consideration, particularly in terms of ensuring that the likely outcomes of a new scheme are achieved efficiently and effectively and that the best value from public funds is secured. In 2015, an analysis of the potential Deposit Protection Scheme costings was undertaken and the estimated costings were as follows: Set-up Year: €1.5m; annual operation: €3.5m - €4m. However, there have been significant changes to interest rates, the financial market and rents since then and careful consideration would be required to introduce any necessary reforms and enhancements to the 2015 scheme, with a view to considering whether and how to introduce a re-designed scheme that is fit for purpose and suitable for current and future rental and financial markets. Following completion of the review of the existing provisions and other matters, it is anticipated that legislative changes will be required and these will need to be developed and progressed through the Oireachtas. QUESTION

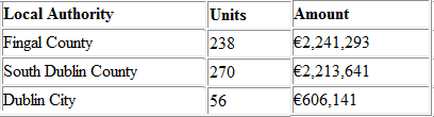

* To ask the Minister for Housing; Planning and Local Government the estimated first and full year cost of doubling the number of whole-time equivalent staff working on the private rented sector functions in local authorities. * To ask the Minister for Housing; Planning and Local Government the estimated first and full year cost of doubling expenditure on the private rented sector functions in local authorities. REPLY The Strategy for the Rental Sector, published in December 2016, set out a series of measures to be introduced to ensure the quality of private rental accommodation by strengthening the applicable standards and improving the inspection and enforcement systems. On 1 July 2017, updated regulatory standards, the Housing (Standards for Rented Houses) Regulations 2017, came into effect. These Regulations focus on tenant safety and include new measures covering heating appliances, carbon monoxide and window safety. In August, my Department published a guidance document to assist and support local authorities in implementing the new Regulations. All landlords have a legal obligation to ensure that their rented properties comply with these regulations and responsibility for the enforcement of the Regulations rests with the relevant local authority, previously supported by a dedicated stream of funding provided from a portion of the proceeds of tenancy registration fees, collected by the Residential Tenancies Board (RTB). Since establishment of the RTB, over €34 million has been paid to local authorities to assist them in the performance of their functions under the Housing Acts, including the inspection of rented accommodation. Over 185,000 inspections were carried out during this period. The Department offers a subvention to local authorities to carry out inspection of properties under the Housing (Standards for Rented Houses) Regulations with funding dispersed on the basis of €100 per inspection carried out and €50 per follow-up inspection that achieves compliance. However, the Rental Strategy recognises the need for additional resources to be provided to local authorities to aid increased inspections of properties and ensure greater compliance with the Regulations. Provision has been made for an additional €2.5m in 2018, with the intention of providing further increases each year in the period to 2021 to facilitate a targeted inspection coverage of 25% of rental properties annually. Under section 159 of the Local Government Act 2001, each Chief Executive is responsible for the staffing and organisational arrangements necessary for carrying out the functions of the local authorities for which he or she is responsible. Consequently, it is a matter for each authority to consider what level of staffing and resources are appropriate in order for the authority to fulfil its statutory and regulatory functions. in this context, it is not possible to provide the specific information sought. QUESTION To ask the Minister for Housing; Planning and Local Government the planning rebate scheme uptake; the cost per annum by local authority since its establishment; and if he will make a statement on the matter. To ask the Minister for Housing; Planning and Local Government the estimated first and full year cost of reducing the planning rebate scheme minimum unit threshold from 50 to 5 units; and if he will make a statement on the matter. REPLY The Development Contribution Rebate Scheme was introduced in 2015 to enhance the viability of the construction and sale of residential units at affordable prices in locations of greatest need. The rebate is applicable in respect of units that were completed and sold after 1st January 2016 and before 31st December 2017 that meet the other conditions of the scheme, including that eligibility is confined to residential developments of at least 50 housing units. The scheme only applies to the metropolitan areas of Cork City and County Councils and all of the Dublin local authority areas. The first recoupments were made under the scheme this year and to date some €2.8m has been paid to local authorities in respect of 326 housing units; further claims are on hand for processing which will take total recoupments under the scheme to over €5m in respect of 564 units, broken down as follows: Given that the timeframe for the scheme, within which it was open to developers to deliver and sell qualified units, has passed, I am not considering any proposals to adapt or extend the scheme. It is not possible to estimate the cost of extending the scheme in the manner suggested as this would depend on the number of units that would meet the scheme criteria.

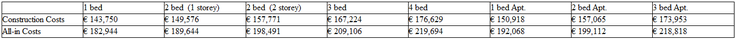

QUESTION To ask the Minister for Housing; Planning and Local Government the average cost of one, two, three and four bed local authority new build units on the basis of costings submitted to his Department by local authorities over the past 12 months; the all-in costs and construction only costs; and the itemised costed list of the individual non-construction costs for each unit size. REPLY The information sought in relation to average costs, to the extent and in the format to which it is readily available, is set out in the table below. The costs set out below are average costs arising in local authority areas, which are based on the analysis of returned data from tendered social housing schemes over an extended period. Construction cost figures are reflective of building costs (including VAT) and also include normal site works and site development. All-in costs include cost of construction, land cost, professional fees, utility connections, site investigations/surveys, archaeology where appropriate, and contribution to public art. Abnormal costs are excluded from these figures. My Department continues to maintain a clear focus on delivering value for money both in terms of the construction and all-in costs of social housing projects.

QUESTION

To ask the Minister for Finance the estimated first and full year cost of expanding the living city initiative criteria to all areas. REPLY The Special Regeneration Areas for the Living City Initiative were designated following consultation with the relevant city councils and an independent review by a third party advisor. Specific qualifying criteria were set down that were required to be taken into account by the city councils when putting forward the proposed Special Regeneration Areas for each city. In particular, it was stated that the Special Regeneration Areas should be inner city areas which are largely comprised of dwellings built before 1915, where there is above average unemployment and which demonstrate clear evidence of neglect, dereliction and under-use. It was also specified that areas which are generally regarded as affluent, have high occupancy rates and which do not require regeneration should not be included. Officials in my Department reviewed the Living City Initiative in 2016 in consultation with the relevant councils and the Department of Arts, Heritage, Regional, Rural and Gaeltacht Affairs. On foot of that review, a number of changes to the scheme were announced in Budget 2017 in order to make the Initiative more attractive and effective. The principal change extended the residential element of the scheme to landlords, who are now able to claim the relief by way of accelerated capital allowances for the conversion and refurbishment of property, which was built prior to 1915, where such property is to be used for residential purposes. In addition, the requirement for a pre-1915 building to have been originally constructed for use as a dwelling in order to qualify for the residential element of the Initiative was removed. The floor area restriction for owner-occupiers has also been removed. Furthermore, the minimum amount of capital expenditure required for eligibility for relief, under all elements of the scheme, was also amended and must now only exceed €5,000. The possibility of extending the Special Regeneration Areas was considered, but it was decided that such a change would dilute the Initiative's potential impact on the originally targeted areas. Revenue have informed me that in order to cost the Deputy's proposal, they would require information on the number of eligible properties in areas outside of the current Special Regeneration Areas. This information is not available from tax returns or other sources, and as such, Revenue are not able to provide this estimation. |

pqs

All Parliamentary Questions I make about Housing, Planning and Local Government and their answers can be viewed in this section Archives

December 2019

|