|

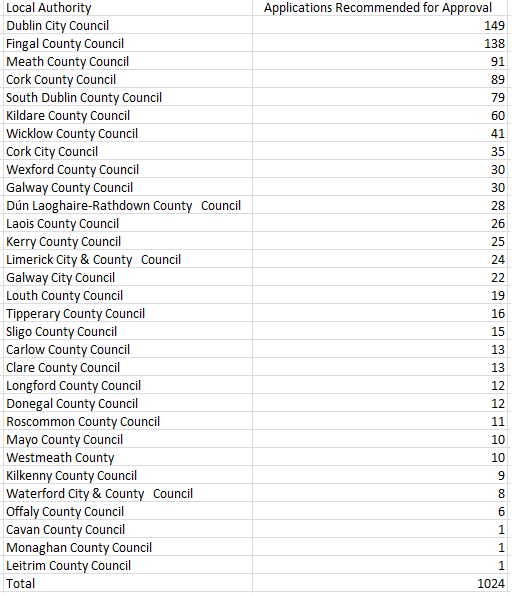

To ask the Minister for Housing; Planning and Local Government the number of applications received for the Rebuilding Ireland home loan scheme; the number of successful applicants; the amount issued to date; the interest rate applied by county in tabular form; and if he will make a statement on the matter. REPLY As with the previous local authority home loan offerings, loan applications under the Rebuilding Ireland Home Loan are made directly to the local authority in whose area the property proposed for purchase is situated. My Department does not directly collect information on the number of loan applications received by each local authority. However, as is currently the case, my Department will continue to publish information on the overall number and value of (i) local authority loan approvals and (ii) local authority loan drawdowns. Information up to Q4 2017 is available on the Department's website at the following link: http://www.housing.gov.ie/housing/statistics/house-prices-loans-and-profile-borrowers/local-authority-loan-activity, and this information is updated on a quarterly basis as additional data is compiled. In addition, the Housing Agency provides a central support service which assesses loan applications that are made to the local authorities and makes recommendations to the authorities as to whether loans should be offered to applicants. I have asked the Agency to centrally compile figures on the numbers of applications that it has assessed and the most recent figures, as at the end of August, indicate that the Agency had received a total of 2,628 applications for assessment from local authorities. Of the 2,628 applications received, 2,074 were deemed to be valid. Of these valid applications, 1,989 had been assessed and 1,024 of these (51%) had been recommended for approval. A breakdown by local authority of the 1,024 applications recommended for approval is set out in the table below. Each local authority must have in place a credit committee and it is a matter for the committee to make the decision on applications for loans, in accordance with the regulations, having regard to the recommendations made by the Housing Agency.

The Rebuilding Ireland Home Loan offers three interest rate products: 2% fixed for up to 25 years (APR 2.02%)*, 2.25% fixed for up to 30 years (APR 2.27%)*, and 2.30% variable (subject to fluctuation) for up to 30 years (APR 2.32%)* Applicants have the option to choose from between these three rates. Mortgage rates are set on the date of drawdown of the loan. The fixed rates are set for all loans drawn down from the first tranche of €200m of fixed-rate financing secured by the Housing Finance Agency. Rates for further tranches may be subject to change and are dependant on the overall rates secured for each tranche.

0 Comments

* To ask the Minister for Housing; Planning and Local Government the anticipated number of affordable, social and private units to be developed under the land development agency per annum from its inception; and if he will make a statement on the matter.

* To ask the Minister for Housing; Planning and Local Government the location the new land agency will be based; the anticipated number of staff and annual operating budget; and if he will make a statement on the matter. - Darragh O'Brien T.D. REPLY To support the work of the Land Development Agency, the Government has agreed new policies requiring that a minimum of 30% of public lands coming forward for redevelopment and/or disposal are to be reserved for affordable housing purposes (in addition to the statutory requirement for 10% social housing under the existing Part V provisions), ensuring more housing supply at more affordable prices and rents. Ahead of its launch earlier this month, the LDA has secured access to State lands which can yield 3,000 new homes. It is currently in discussions with State bodies in relation to land for another 7,000 homes and a minimum of 40% of the homes built on all State land will be in the form of a mix of social and affordable housing. Subsequent to the Agency's establishment last week, a detailed business plan and development programme is currently being prepared and will be finalised shortly, and this plan will set out further detail in relation to the initial and longer-term tranches of sites and the anticipated delivery of homes on such sites. Detailed arrangements for the operation of the Agency are currently being developed by my Department, in conjunction with the Department of An Taoiseach and the Department of Public Expenditure and Reform, with a view to their early finalisation. While the Agency currently has three core staff at its establishment, it is expected to expand its existing capacity over the coming weeks, and in time may employ around 25 people, with the requisite skills and experience to deliver on its policy and legislative mandate. To ask the Minister for Employment Affairs and Social Protection the amount spent on rent supplement in each of the years 2011 to 2017 and to date in 2018; and if she will make a statement on the matter.

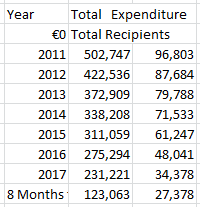

To ask the Minister for Employment Affairs and Social Protection the number of recipients on rent supplement in each of the years 2011 to 2017 and to date in 2018; and if she will make a statement on the matter. REPLY Rent supplement plays a vital role in housing families and individuals, with the scheme supporting approximately 27,400 recipients for which the Government has provided €180 million for in 2018. End of year statistics for rent supplement recipients and expenditure for the years 2011 to 2017 and for the eight months ending August 2018 are provided in the attached tabular statement. Rent supplement customer numbers have declined significantly since 2011. The strategic initiative of returning rent supplement to its original purpose, that of a short-term income support, facilitated by the introduction of the HAP scheme has been the main driver in rent supplement’s base decline. Other contributory factors include the continuing improvement in the economy leading to fewer people seeking support due to retaining and securing long-term employment allied with more people exiting rent supplement through activation and securing job opportunities. I trust this clarifies the matter for the Deputy. Tabular Statement: Rent Supplement: Recipient Numbers & Expenditure 2011 - 2017 and Eight Months Ending August 2018 |

pqs

All Parliamentary Questions I make about Housing, Planning and Local Government and their answers can be viewed in this section Archives

December 2019

|